Emerging Signals

Hand-picked analysis and perspectives from Tellimer’s analysts — a selection from our platform, reflecting the depth of insight we deliver to investors, banks, and policymakers worldwide.

26 Jan 2026

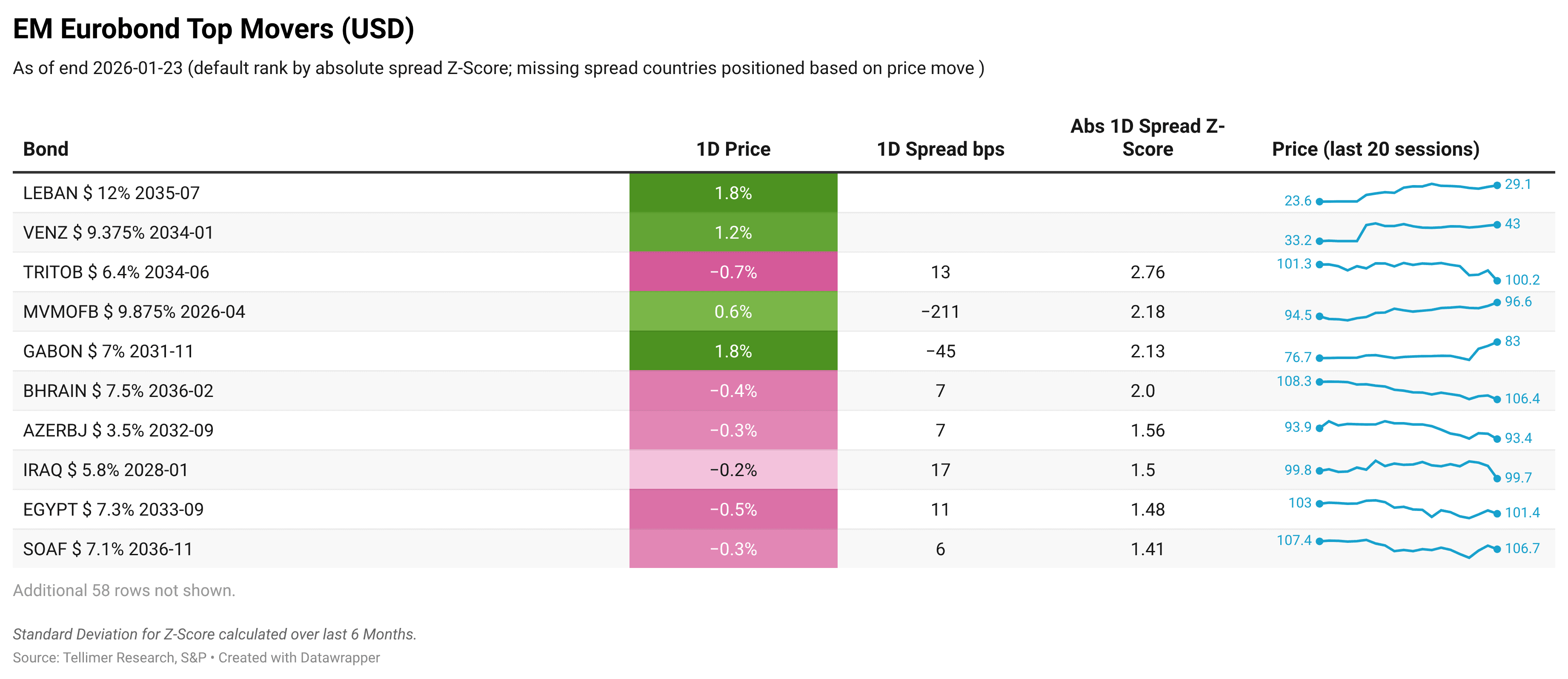

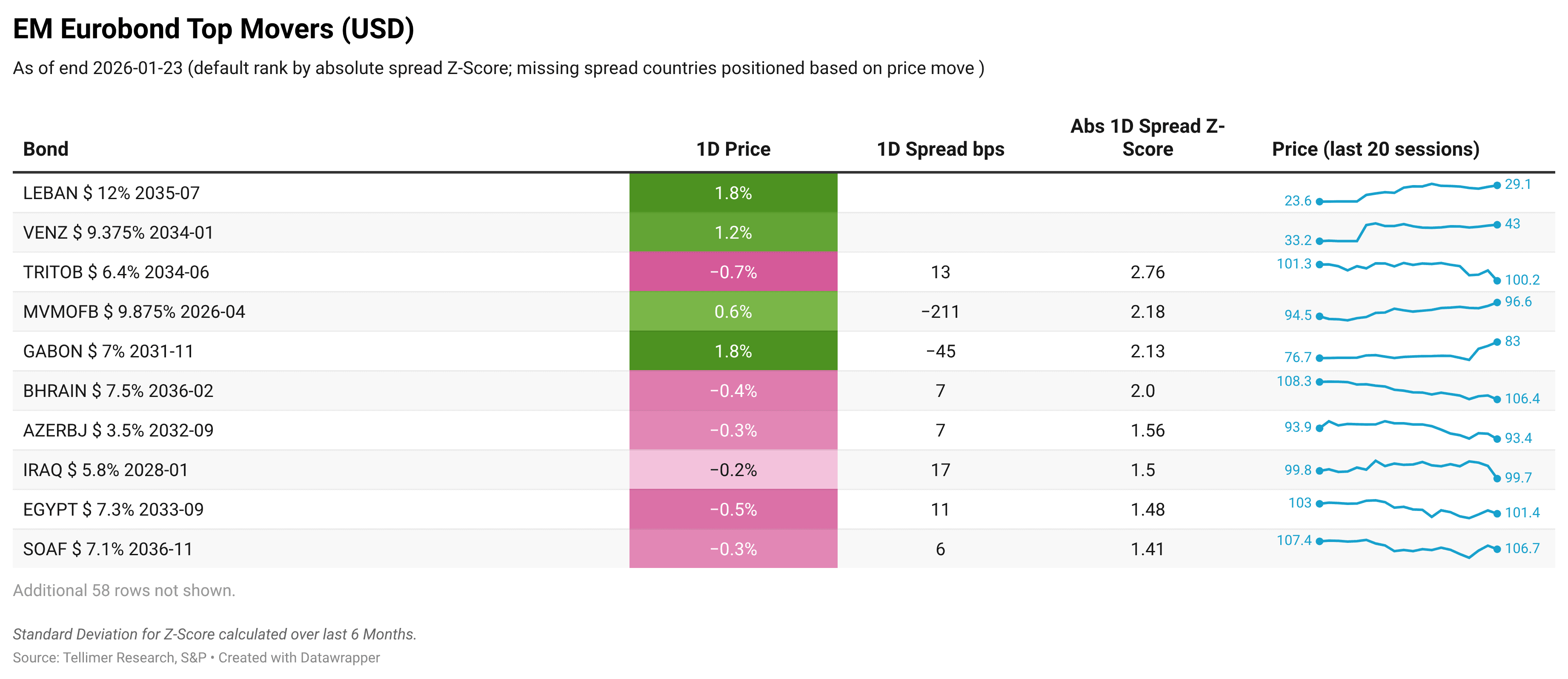

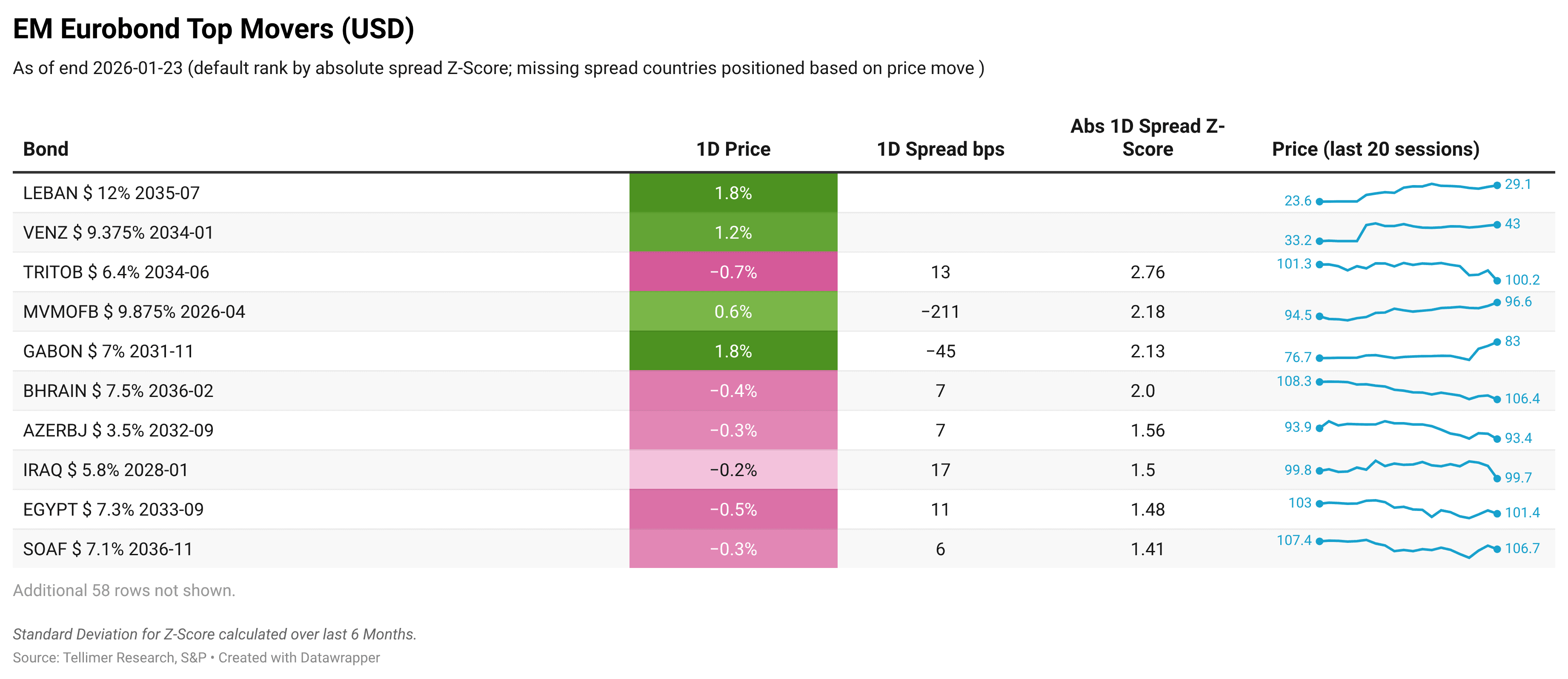

Gabon 2031s +1.8%, extending gains after the IMF announced a staff mission next month, lifting hopes of a Fund programme. Lebanon 2035s +1.8%, on confirmation of an IMF mission in February and progress on bank-deposit law reforms. Venezuela 2034s +1.2%, as the US prioritises short-term stability and control of oil flows.

26 Jan 2026

Gabon 2031s +1.8%, extending gains after the IMF announced a staff mission next month, lifting hopes of a Fund programme. Lebanon 2035s +1.8%, on confirmation of an IMF mission in February and progress on bank-deposit law reforms. Venezuela 2034s +1.2%, as the US prioritises short-term stability and control of oil flows.

26 Jan 2026

Gabon 2031s +1.8%, extending gains after the IMF announced a staff mission next month, lifting hopes of a Fund programme. Lebanon 2035s +1.8%, on confirmation of an IMF mission in February and progress on bank-deposit law reforms. Venezuela 2034s +1.2%, as the US prioritises short-term stability and control of oil flows.

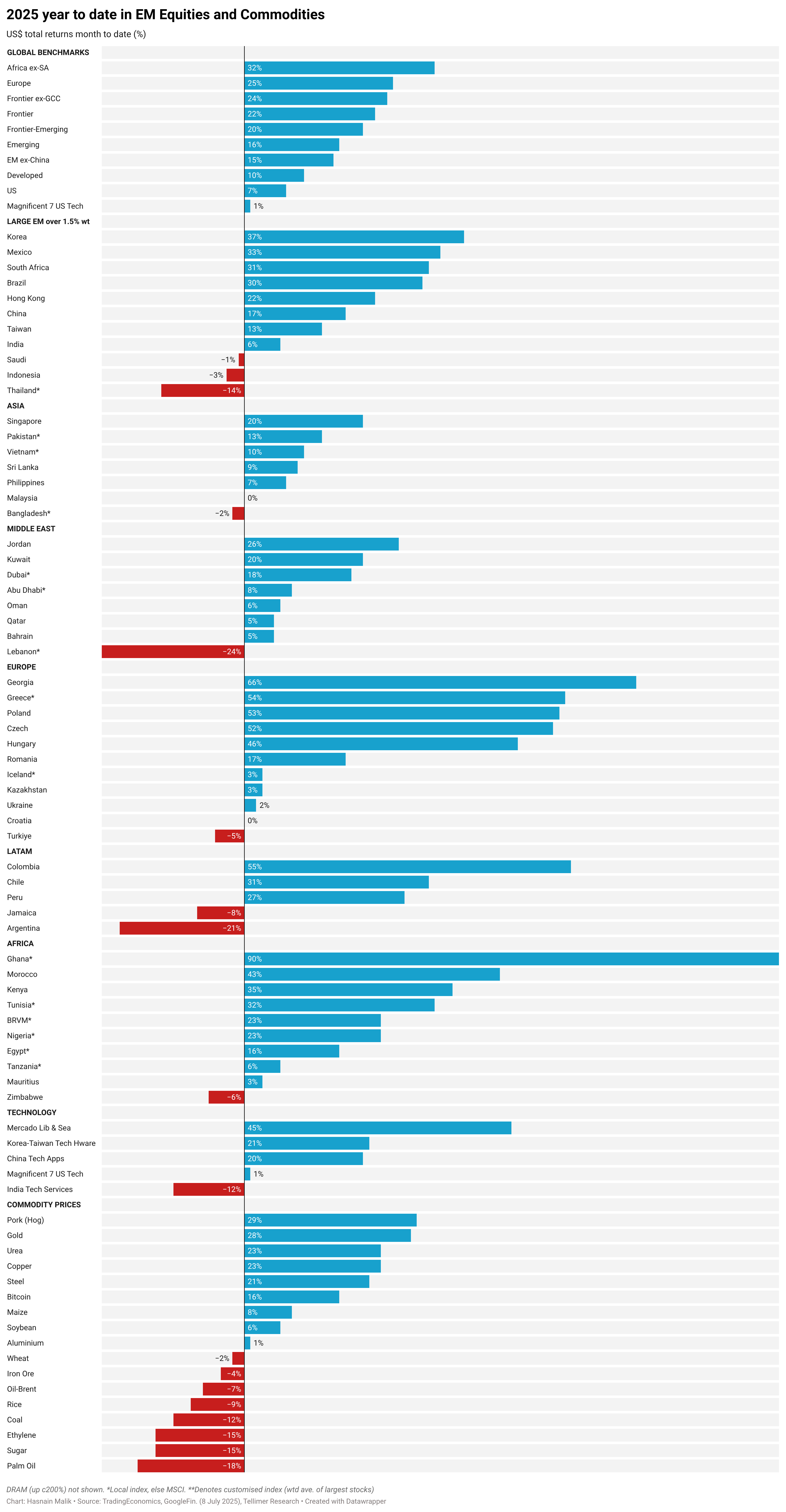

9 Jul 2025

9 Jul 2025

9 Jul 2025

Power up your EM analysis

Unique data & analysis

EM focus

Powerful platform

Power up your EM analysis

Unique data & analysis

EM focus

Powerful platform

Power up your EM analysis

Unique data & analysis

EM focus

Powerful platform