Tellimer's Sovereign Probability of Default model

Tellimer’s fundamentals-driven model quantifies sovereign eurobond default risk over the next 12 months, updated monthly and expressed as a transparent 0–100% probability.

Proven ability to identify sovereign distress

Our model delivers strong early-warning performance across historical default events:

92.9% capture rate: 26 of the last 28 defaults identified within a 12-month horizon

False-alarm rate of just 1.8%

Average lead time of over 8 months

This level of accuracy supports use cases such as portfolio monitoring, risk management, and forward-looking country screening, outperforming or matching leading early-warning benchmarks.

Transparent and defensible sovereign risk estimates

The two-tier architecture is designed for explainability rather than black-box behaviour.

Tier 1 is an interpretable logistic model based on macro-fiscal fundamentals

Tier 2 applies a lightweight nonlinear adjustment trained on residuals, capturing idiosyncratic effects while preserving traceability

This structure supports model governance, and regulator-facing documentation that require clarity on the drivers of PD changes.

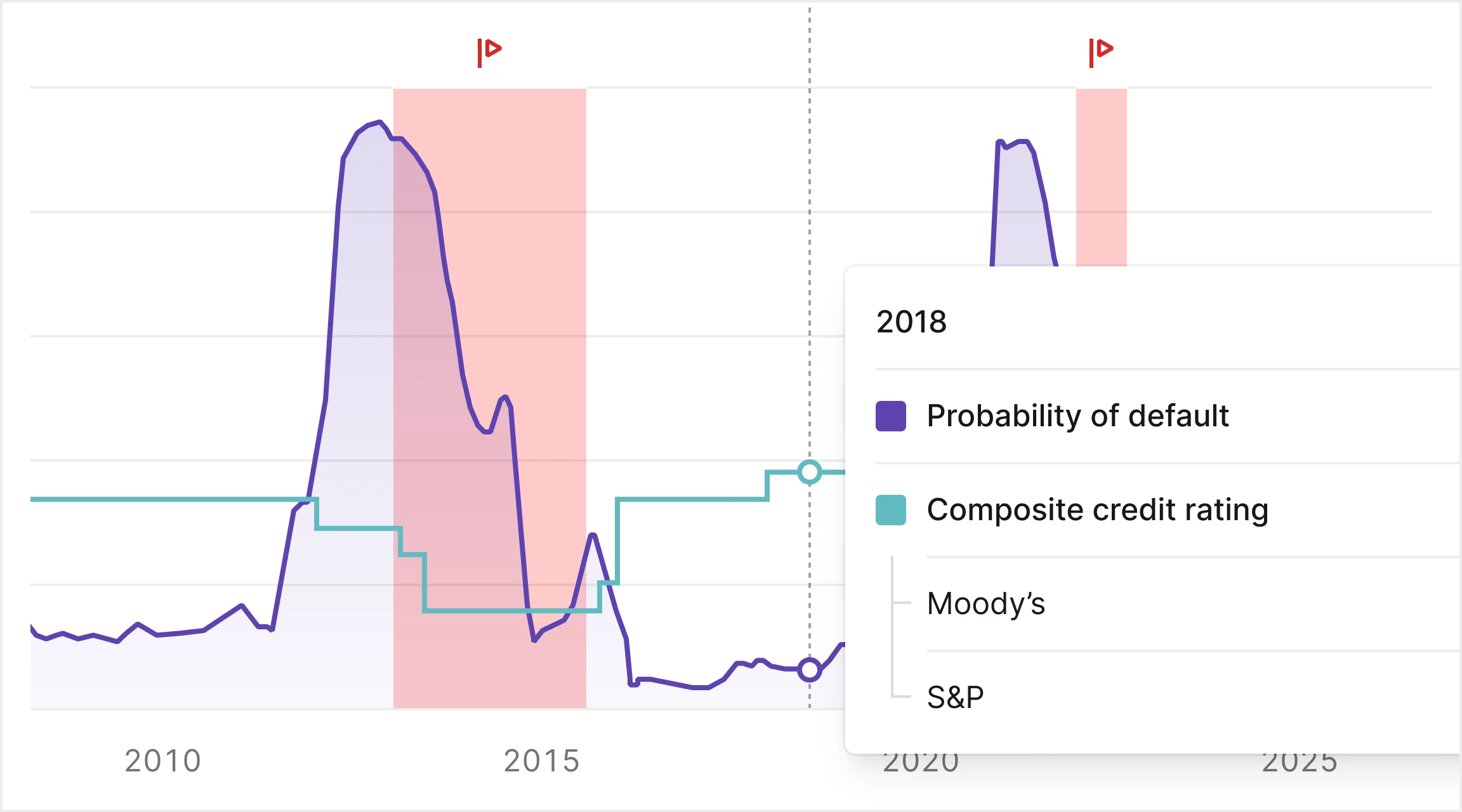

Earlier adjustment to risk than credit ratings

Updated monthly and anchored in evolving fundamentals, the PD signal frequently detects deteriorating conditions well before sovereign credit ratings move.

In default cases such Congo (2015), Mozambique (2016), Lebanon (2020), the model provided materially earlier warnings to ratings downgrades, enabling users to anticipate rating actions and respond proactively to rising sovereign risk.

Fundamentals-based insight to identify market mispricings

By avoiding market-price inputs, the PD estimate reflects economic reality rather than sentiment-driven volatility.

This fundamentals-based perspective helps users identify relative mispricings versus sovereign spreads, highlight disconnects between fundamentals and market pricing, and better position for repricing events. In default cases such as Argentina (2020) and Sri Lanka (2022), the model signalled fundamental deterioration well ahead of market adjustment, underscoring its ability to detect mispricing before stress becomes disorderly.

Built for real-world workflows with clean, point-in-time monthly data

A fully point-in-time monthly dataset ensures every PD estimate reflects only the information available at that date, eliminating look-ahead bias and enabling clean backtests, scenario analysis, and strategy evaluation.

This foundation integrates seamlessly into sovereign risk management, portfolio monitoring, investment screening, and macro-financial analysis.

Inputs span macroeconomic, fiscal, external, financial, and political indicators from IMF WEO vintages, World Bank, Bruegel, and national sources, with forecasts and revisions blended to track evolving expectations.