Frontier Daily, 26 January: Gabon, Lebanon, Venezuela, Argentina gain

Jamie Fallon

—

Economist

26 Jan 2026

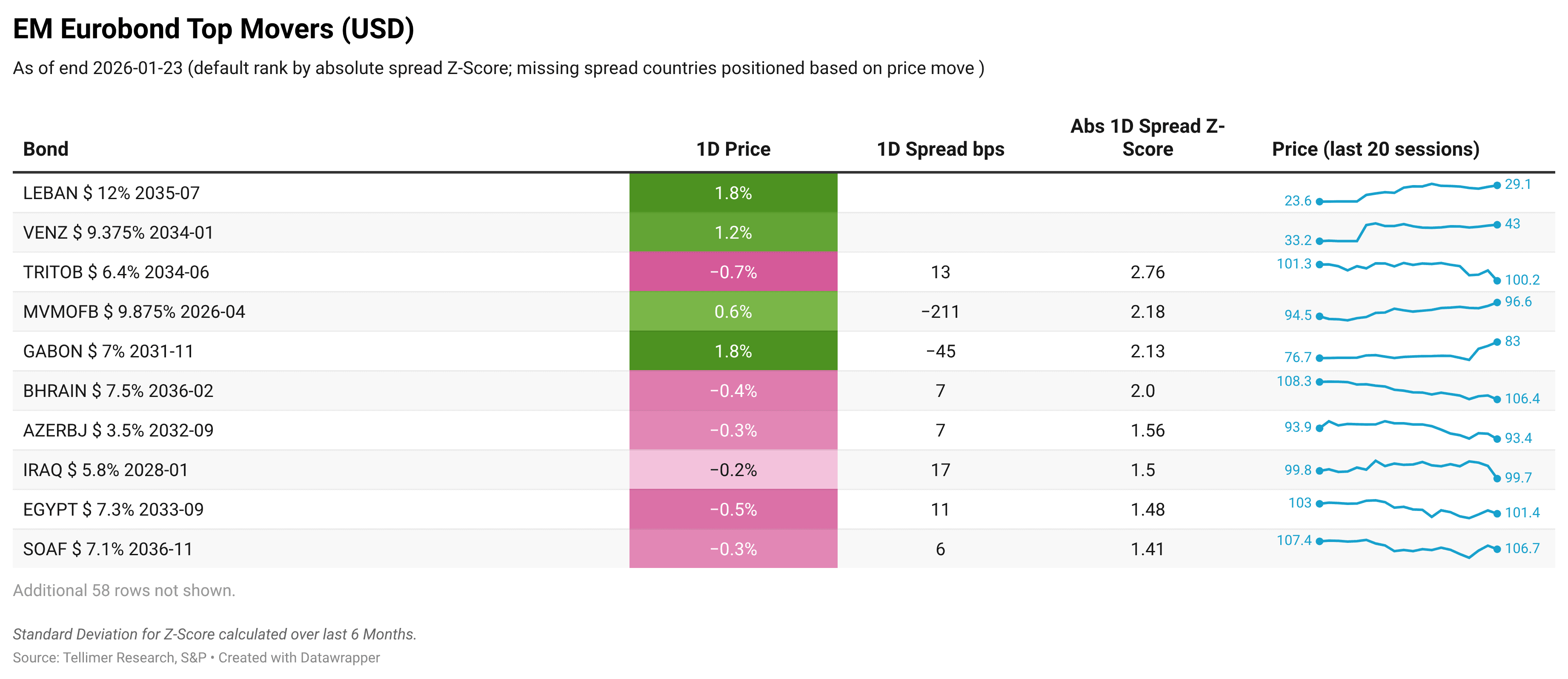

Gabon 2031s +1.8%, extending gains after the IMF announced a staff mission next month, lifting hopes of a Fund programme

Lebanon 2035s +1.8%, on confirmation of an IMF mission in February and progress on bank-deposit law reforms

Venezuela 2034s +1.2%, as the US prioritises short-term stability and control of oil flows

EM eurobonds were broadly flat on Friday, with spreads widening by 2bps (based on the median across our sample), while the US 10-year yield eased c1bps to 4.23%. Meanwhile, rising US-EU geopolitical tensions have revived discussion of a potential “Sell America” trade, though coordinated EU divestment from US Treasuries remains unlikely given legal, political and economic constraints. If such sales were to materialise, higher US yields would raise the global risk-free rate and weigh on EM assets, but this could be more than offset by a weaker dollar, ultimately reinforcing the relative appeal of EMs, especially those with orthodox policies, strong external buffers and exposure to gold and hard commodities.

Europe, Middle East

Lebanon's 2035 eurobonds climbed 1.8% on Friday after the government announced the IMF would send a mission to the country from 9 February to 13 February to continue technical discussions. PM Salam reportedly met with IMF Chief Georgieva at Davos. News emerged last week that the IMF had requested that the country amend its bank-deposit law. We examined the long-awaited draft law earlier this month, describing it as a step in the right direction, moving the country closer to restructuring.

Ukraine's 4½ 2036 eurobonds fell 0.7% on Friday after no notable developments emerged after the diplomatic flurry on Thursday at Davos. Trump had said he had a "good" meeting with Ukrainian President Zelenskiy at Davos. Still, the UKRAIN '36s remained up 4.4% from Tuesday's lows when the Greenland crisis threatened to weaken Ukraine's bargaining position in peace talks.

Read the full report on the Tellimer App

Jamie Fallon is an economist @ Tellimer focussed on emerging market macro research.