Wall of supposed EM fears: Trump unpredictability, higher US rates for longer, military and trade wars, China slowdown

Instead, much comfort: US $ drop and investor flight, benign commodity prices, and idiosyncratic country-level positives

2H 2025 risks: US$ stabilises, commodity prices follow the example of gold, EM commitment to better policies erodes

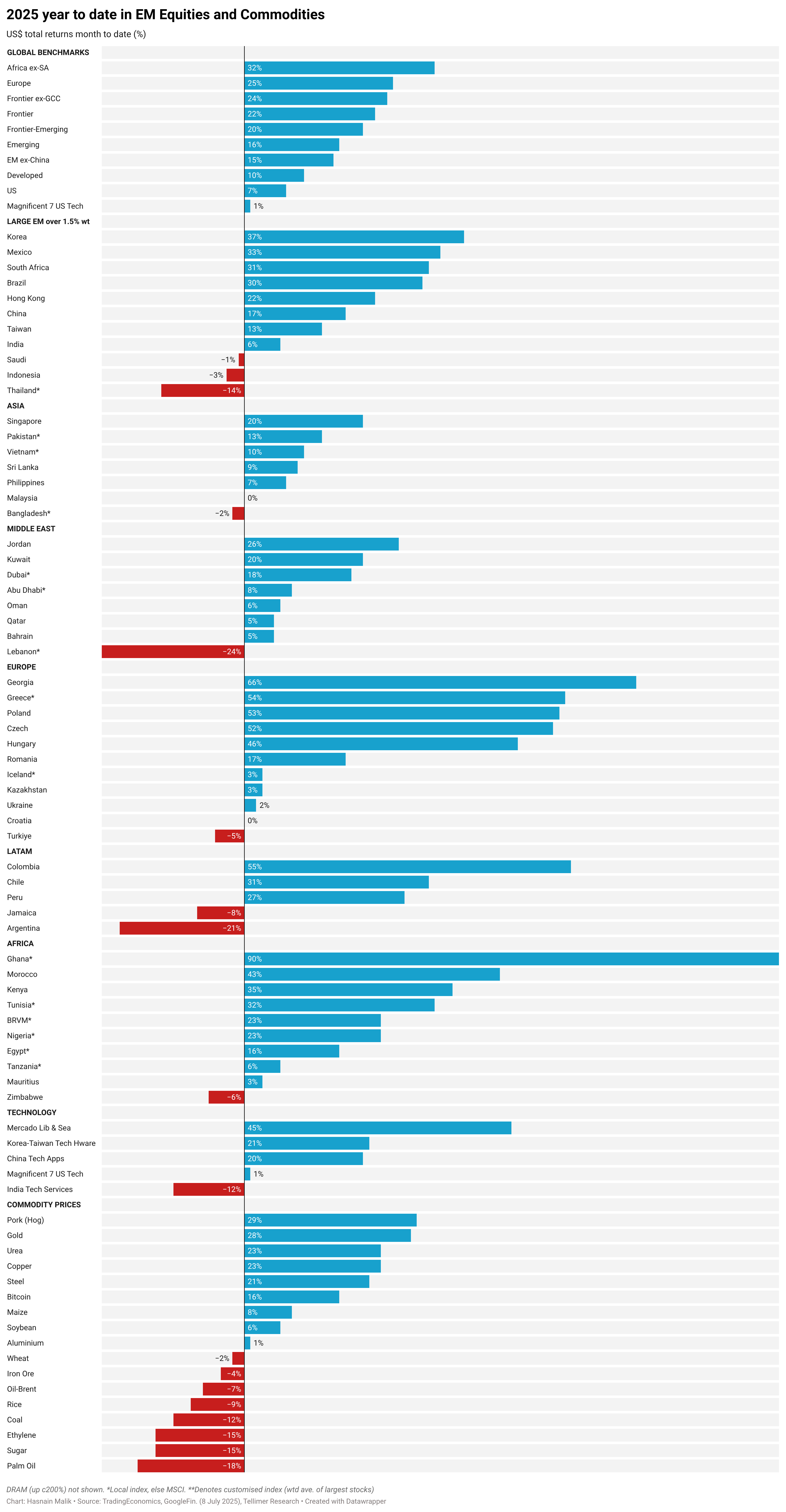

What a surprisingly fantastic year so far for emerging and frontier market equities! Everyone is living in US President Trump's world (and by the beat of his social media posts), but, so far, it is one that has proved far more beneficial for EM assets, relative to the US assets, than many might have predicted.

EM (MSCI) has outperformed the US (S&P 500) by about 9 percentage points ("frontier" by even more), and China-Korea-Taiwan Tech has outperformed the US Mag7 Tech by c20ppts (performance figures are in total US$ returns and as of the open on 8 July).

The laggards have been Indonesia, Saudi Arabia, and Thailand in Large EM, and Argentina, Bangladesh, and Turkey in Small EM and Frontier — we look at these in more detail later in this report and argue it may be time to consider some of them too.

Trump's unpredictability (on trade, migration, and foreign policy), combined with higher US rates for longer, China's terminal macroeconomic decline (demographic ageing, excess real estate and debt, market-unfriendly regulation), military wars (Russia Ukraine, Israel Gaza, Israel Iran, India Pakistan) could reasonably have been expected to harm EM performance.

Instead Trump has proved so disruptive for global confidence in US policy-making, institutional checks and balances, and inflation and fiscal deficit outlooks that investors have driven the US dollar down c10% (the beginning of the end of "US exceptionalism"). And, despite what all of us who research EM would like to argue about structural growth and change (whether at the country or company level), there is no tailwind as strong for EM as a weakening US dollar.

Read the full report on the Tellimer App

Hasnain Malik is Head of EM Equity Strategy @ Tellimer.